forum

library

tutorial

contact

A Bright Year for Solar in the U.S.

-- But There are Clouds on the Horizon

by Bryan Walsh

Time, March 5, 2014

|

the film forum library tutorial contact |

|

A Bright Year for Solar in the U.S.

by Bryan Walsh

|

Solar was the second-biggest source of new electricity generation capacity in 2013.

A trade war between the U.S. and China, however, could change all that

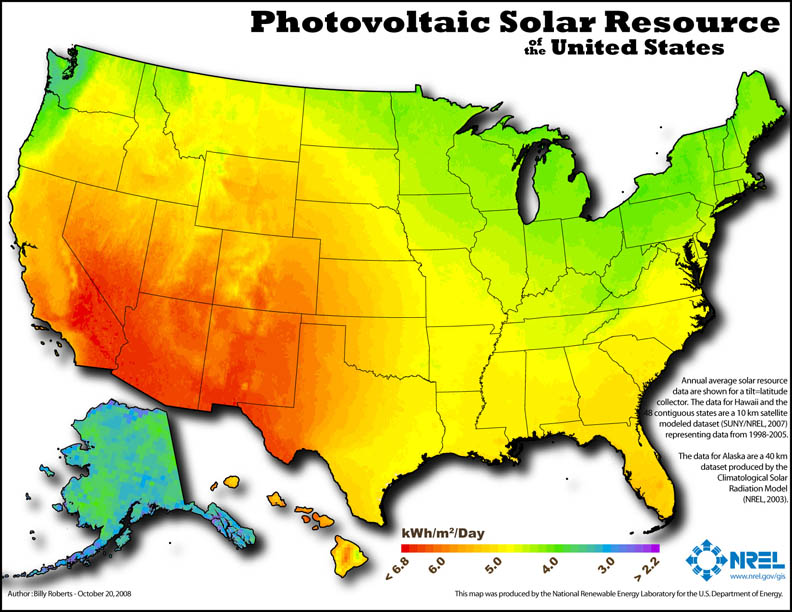

You don't get any brighter than the reflecting mirrors at the just-opened Ivanpah Solar Power Facility, in California's Mojave desert. When I visited the project back in May, I was warned not to look directly at the mirrors, lest my eyeballs end up as scorched as some of the birds that have flown through the 1,000degrees F-plus (538degrees C) heat generated by the solar towers. The picture is almost as bright for solar as a whole in the U.S. According to statistics released today by the Solar Energy Industries Association, a trade group, demand for solar increased by 41% in 2013, with 4.75 gigawatts of photovoltaic panels installed last year. (1 GW is about enough energy to power 750,000 homes.) That made solar the second-biggest source of new generation power in the U.S. after natural gas, which is still benefiting from the shale revolution. By the end of 2013, there were more than 440,000 operating solar electric systems in the U.S., with more than 12 GW of photovoltaic (PV) and nearly 1 GW of concentrated solar power.

You don't get any brighter than the reflecting mirrors at the just-opened Ivanpah Solar Power Facility, in California's Mojave desert. When I visited the project back in May, I was warned not to look directly at the mirrors, lest my eyeballs end up as scorched as some of the birds that have flown through the 1,000degrees F-plus (538degrees C) heat generated by the solar towers. The picture is almost as bright for solar as a whole in the U.S. According to statistics released today by the Solar Energy Industries Association, a trade group, demand for solar increased by 41% in 2013, with 4.75 gigawatts of photovoltaic panels installed last year. (1 GW is about enough energy to power 750,000 homes.) That made solar the second-biggest source of new generation power in the U.S. after natural gas, which is still benefiting from the shale revolution. By the end of 2013, there were more than 440,000 operating solar electric systems in the U.S., with more than 12 GW of photovoltaic (PV) and nearly 1 GW of concentrated solar power.

While big utility scale plants like Ivanpah, which harnesses the heat of the sun with concentrated solar mirrors, got most of the headlines, it was small-scale residential systems that drove much of the demand last year. Residential projects increased by 60% over 2012 as the price of installing solar fell and as customers took advantage of leasing options -- offered by companies like Solarcity, which I wrote about last year -- that allowed them to purchase panels with little money up front. The growth was rolling throughout 2013, with residential installations increasing 33% in the last quarter of 2013, and should continue this year. That financing market is growing: Mosaic, an Oakland-based startup launched by the climate activist Billy Parish, just began offering a home solar loan that allows consumers the chance to borrow the cost of a solar system over 20 years. "2013 offered the U.S. solar market the first real glimpse of its path toward mainstream status," said Shayle Kann, vice president of GTM Research, which follows the clean tech market.

Bright times for solar, indeed -- and that's just in the U.S. Last year China installed at least 12 gigawatts of solar capacity, at least 50% more than any other country had ever built in a single year. But that's where things get cloudy. The U.S. solar boom has been fueled in part by cheap solar panels from China, which have helped bring down the cost of solar power -- now 15% cheaper than it was in 2012. But those same cheap Chinese panels have hurt domestic manufacturers of solar PV, even as they've helped installers like Solarcity. Several domestic solar manufacturers -- led by SolarWorld, an American arm of a German company -- have complained that the Chinese government is unfairly subsidizing national solar PV manufacturers, which allows them to undercut their American competitors.

In response, the U.S. government agreed in 2012 to impose tariffs of 24 to 36% on Chinese PV panels. But that made little difference -- Chinese companies just outsourced much of their production to Taiwan. This year, however, SolarWorld brought a new suit in response, pushing the U.S. to extend those tariffs to Chinese panels made in Taiwan. Last month, the U.S. International Trade Commission said it would move forward with an investigation, and is set to issue a preliminary ruling by the end of March. If those tariffs are indeed extended, you can expect solar power in the U.S. to get more expensive, slowing down growth and hitting installers -- who employ far more Americans than U.S. solar manufacturers do -- very hard, especially since China has already said it would impose retaliatory tariffs. More expensive panels would likely depress demand for solar in the U.S., hurting installers.

There's some truth to the argument that China may be intentionally driving down the price of solar panels to allow its companies to dominate the industry. But if so, the strategy hasn't been that effective -- a number of Chinese manufacturers have gone bankrupt, including Suntech, which was until recently the world's biggest panel maker by volume. The U.S. solar industry is at a tipping point, poised to grow its way out of niche status and potentially change the way Americans think -- and more importantly, pay for -- energy. It'd be a shame if a 21st century industry gets tripped up by 19th century trade politics.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum