forum

library

tutorial

contact

Next Steps for Moving Energy

Recovery Hydropower Forward

by Kurt Johnson

HydroWorld, March 1, 2018, 2018

|

the film forum library tutorial contact |

|

Next Steps for Moving Energy

by Kurt Johnson

|

Legislation passed in the U.S. in 2013 helped create a new industry: energy recovery hydropower.

However, due to recent electricity market conditions, growth has been slow.

August 2013 marked the beginning of a new industry in the U.S.: energy recovery hydropower. Before the Congress approved the Hydropower Regulatory Efficiency Act (HREA), developers of even the smallest conduit hydropower projects were required to submit a detailed application to the Federal Energy Regulatory Commission (FERC), which rendered many of these projects economically infeasible due to high regulatory compliance costs. HREA made it possible for "qualifying conduit" projects to receive FERC approval in 60 days.

August 2013 marked the beginning of a new industry in the U.S.: energy recovery hydropower. Before the Congress approved the Hydropower Regulatory Efficiency Act (HREA), developers of even the smallest conduit hydropower projects were required to submit a detailed application to the Federal Energy Regulatory Commission (FERC), which rendered many of these projects economically infeasible due to high regulatory compliance costs. HREA made it possible for "qualifying conduit" projects to receive FERC approval in 60 days.

Despite the promise of this reform, industry growth has been slow. Between August 2013 and December 2017, only 94 projects received approval from FERC as qualifying conduits, not all of which have actually been built. This article explains why and suggests additional federal efforts that may help spur the growth of energy recovery hydropower in the U.S.

MARKET OPPORTUNITY

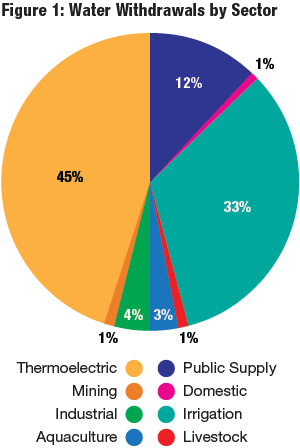

There is substantial untapped opportunity for energy recovery hydropower in the U.S. Billions of gallons of water are withdrawn each day from existing natural water sources. Sectors responsible for significant water consumption include thermoelectric power generation, agriculture and public supply (see Figure 1).

Some of the energy embedded in this water, as it is delivered for its intended purpose, can be harvested using energy recovery hydropower. For example, the U.S. water transmission and distribution system includes hundreds of thousands of pressure reduction valves (PRVs), which are mechanical devices that keep water pressure at sufficiently low levels to protect pipelines, plumbing and appliances. PRVs are frequently located in underground concrete vaults. If there is both sufficient space available and proximity to utility interconnection, PRVs can be installed in parallel with small hydropower generators that perform exactly the same function -- reducing pressure -- with the added benefit of simultaneously generating energy.

SLOW INDUSTRY GROWTH

Since the significant FERC process reforms of 2013, only 94 new qualifying conduit projects totaling slightly over 30 MW have received FERC approval -- a rate considerably less rapid then FERC staff had expected in 2013. The leading states for project development to date have been California, Oregon and Colorado (see Figure 2 on original site) -- all of which have topography conducive to hydropower and state policies that actively support energy recovery hydropower.

TOUGH MARKET CONDITIONS

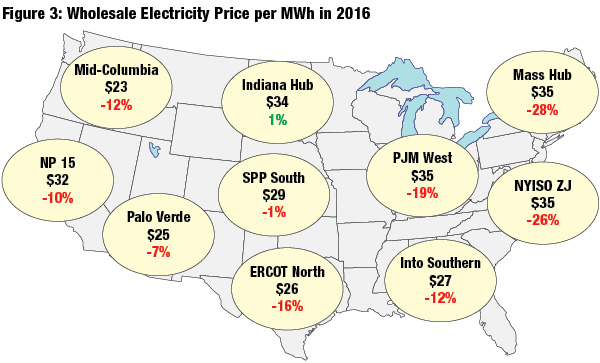

The simplest explanation for slow industry growth is low electricity prices. Average wholesale electricity prices are low by historical standards, ranging from $25 to $35 per MWh in 2016. For comparison, in 2008, average prices nationwide ranged from $63 to $113 per MWh (see Figure 3). In addition, federal production and investment tax credits for hydropower expired at the end of 2016, further adversely impacting the already challenging economics of new hydro project development.

Despite the complication of low wholesale electricity prices, locations with an on-site electricity load that can be net metered may still be economically attractive. For example, water treatment plants typically have an on-site electricity load that can be offset with hydropower generation through net metering -- yielding a much higher value per kWh as opposed to electricity sold into the wholesale market. The average U.S. retail electricity price (combining residential, commercial and industrial sectors) in 2016 was 10.28 cents/kWh. Currently, 41 states and Washington, D.C., American Samoa, U.S. Virgin Islands, and Puerto Rico have mandatory net metering policies in place.

OPTIONS TO ACCELERATE GROWTH

Below are federal actions that could further accelerate growth of energy recovery hydro.

ADDITIONAL FEDERAL REGULATORY REFORM

One logical reform would be addressing the inconsistency between environmental impact and regulatory burden for energy recovery hydropower. HREA represented a significant step forward relative to typical hydropower permitting. However, unlike conventional hydro, energy recovery hydropower in many cases is simply plumbing equipment that generates electricity, located nowhere near an existing natural waterway.

The delay associated with having to file a federal project approval request and then wait 60 days for federal approval before ordering equipment means that project completion cycles for even tiny energy recovery hydropower projects are frequently at least one year and typically longer (compared to several weeks for installation of a typical PRV). Continuing to require a 60-day federal approval process before it is legal to install energy recovery hydropower will likely mean the industry will never grow to become a commonplace energy efficiency upgrade for water operators.

At a May 2017 hydropower hearing of the House Energy and Commerce Committee, the FERC witness recommended removing conduit hydropower projects from FERC jurisdiction entirely, citing the lack of environmental concerns associated with hydropower development using existing conduits.

By definition, energy recovery hydropower does not typically have environmental impact. It uses water that has already been diverted from a natural waterway into a pressurized pipeline for non-hydropower purposes (e.g. municipal, agricultural or industrial). Consequently, any environmental impact associated with diversion from an existing natural waterway would already have occurred, and environmental impacts would usually have been addressed prior to construction of the existing conduit. If there are any incremental impacts (e.g. associated with construction of a new powerhouse building), those would be addressed by existing federal, state and local environmental law.

One possible legislative fix could allow developers of energy recovery hydropower projects the legal right to assert that they be considered qualifying conduits, meaning no need to file with FERC and wait for approval. The owner of such a facility could be required to retain documentation demonstrating that the project meets FERC qualifying conduit criteria and be prepared to provide it to FERC if requested. This would be consistent with other FERC policies allowing small projects to be exempt from filing requirements. It would not change the underlying FERC qualifying conduit eligibility criteria from 2013. It would simply allow installation of energy recovery hydropower to become as quick and easy as installation of distributed wind and solar photovoltaic power (which do not have any federal approval requirements prior to installation) while maintaining the legal right of any stakeholders to protest project eligibility for qualifying conduit status.

One argument against further FERC streamlining for energy recovery hydropower is that it could increase economic incentives to divert water from existing natural waterways, which could potentially have adverse effects if the impacted waterway is impaired. This is an understandable concern. However, water diversions and rights are governed by state water law, not by FERC. Changing the use of an existing water right to add hydropower entails a state, not federal, legal process and disputes over water rights are a state, not federal, legal issue.

INTEGRATION OF HYDROPOWER INTO WATER INFRASTRUCTURE SPENDING

Another logical action would be integrating energy recovery hydropower into federal water infrastructure spending decisions. Water infrastructure is typically funded by local, state and federal government sources, including the multi-billion-dollar State Revolving Funds administered by the Environmental Protection Agency. Water agencies have a primary mission of delivering water and meeting regulatory requirements to protect public health, so analyzing energy data to optimize the energy efficiency of operations -- including through energy recovery hydropower -- has not necessarily been a priority. However, because the water sector is so energy-intensive, it makes sense to routinely investigate whether energy recovery hydropower makes technical and economic sense whenever money is being spent on new water-supply pipelines. This could build on related efforts that have already been developed in New York, California and other states to promote energy efficiency in the water sector.

FEDERAL RESOURCE ASSESSMENT OF ENERGY RECOVERY HYDROPOWER

Perhaps the best federal action would be for the U.S. Department of Energy to complete a comprehensive federal resource assessment of energy recovery hydropower, building upon DOE's successful hydropower resource assessments on non-powered dams. Preliminary DOE conduit hydropower estimates have indicated a national resource of 1,000 to 2,000 MW. However, there has never been a comprehensive, nationwide conduit resource assessment. A comprehensive understanding of the magnitude of the energy recovery hydropower resource could help to guide future policy and program efforts as well as project development.

CONCLUSION

Energy recovery hydropower remains a largely untapped hydropower development opportunity. Notwithstanding significant reforms of 2013, the industry's potential has yet to be realized. Additional federal efforts may help grow the industry from the status of several dozen projects approved by FERC each year to the point where installation of energy recovery hydropower becomes as simple, routine and commonplace as installation of a PRV.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum