forum

library

tutorial

contact

How the Energy Imbalance Market is

Unleashing Renewables and Saving Millions

by Jennifer Delony

Renewable Energy World, December 5, 2017

|

the film forum library tutorial contact |

|

How the Energy Imbalance Market is

by Jennifer Delony

|

Energy markets around the world are seeing more renewables integration, and they are working

to accommodate that additional clean energy by regionalizing power grid operations.

Energy market participants in some regions of the world are facing the challenge of renewables integration head-on, creating a slow, but steady, campaign to redesign their markets and form more regionalized power grids. Europe has a goal of breaking down the regional barriers that keep energy from moving freely around its power grid. And there are few better examples of energy market regionalization than the work of stakeholders on the U.S. West Coast, and in the Pacific North- and Southwest.

Energy market participants in some regions of the world are facing the challenge of renewables integration head-on, creating a slow, but steady, campaign to redesign their markets and form more regionalized power grids. Europe has a goal of breaking down the regional barriers that keep energy from moving freely around its power grid. And there are few better examples of energy market regionalization than the work of stakeholders on the U.S. West Coast, and in the Pacific North- and Southwest.

The U.S. Western Interconnection covers a wide area of North America that shares an interconnected power grid. However, the operation of that grid is broken into independently operated balancing authorities (BA). Each BA must ensure reliability, which means integrating renewable generation while matching energy supply and demand, a job some people think can be more efficient, both economically and operationally, if BA operators functioned as a combined energy market.

Of the 38 BAs in the Western Interconnection, the California Independent System Operator (CAISO) is the largest -- encompassing 80 percent of California and part of Nevada. California's aggressive clean energy goal -- 50 percent by 2030 -- has presented CAISO with significant challenges related to the increased integration of renewable resources to the power grid.

Ravi Pradhan, portfolio manager, Siemens Energy Management, Digital Grid, Software & Solutions, says that, to CAISO's credit, it has not shied away from those challenges. CAISO has pushed the western part of the U.S. toward the realization of a larger regional transmission system operations structure -- a path that other parts of the country likely will follow soon.

Similarly, in Europe, there is an initiative to unify the 42 entities that operate the synchronous grid of continental Europe in order to better accommodate renewables growth. The goal there is to reach a fully integrated internal energy market -- which would require the complete redesign of current energy markets to allow energy to flow freely across Europe without regulatory barriers.

Therein lies the crux of the regionalized transmission system dream -- energy market redesign.

REDESIGNING LEADS TO MAJOR SUCCESS

Because of its progressive stance on addressing the challenges of integrating greater amounts of renewables in California, CAISO presents an interesting example of what is driving the redesign of energy markets and what it takes to get there.

After the California energy crisis in early 2000, CAISO completely overhauled its market design, turning to Siemens to handle the technological aspects of creating what CAISO refers to as the integrated forward market -- or the day-ahead and real-time markets for its BA region. Pradhan said the creation of the current market design was extraordinary, but renewable energy is already changing the game. He can remember sitting in CAISO's control room the first time he saw prices "go negative" because wind resources had picked up in the middle of the night and there were too many other generators already producing energy.

"You can't curtail that, so now what do you do with it?" Pradhan asked.

CAISO didn't want to curtail renewables -- it wanted to find the best way to use them. And when it was ready to make the adjustment to a new approach, CAISO turned again to Siemens to help build what now is called the energy imbalance market (EIM).

"When CAISO started talking about the EIM, it made a lot of sense," Pradhan said. "You have all that wind up in the Northwest that picks up when you need it down in the south and San Diego; you've obviously got all the solar in Nevada, which is slightly offset from a time perspective; and you have all the hydropower in the Northwest. It only made sense to expand the footprint [of the market]."

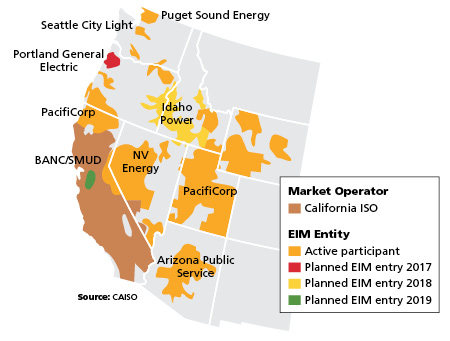

State and jurisdictional boundaries prevented speedy expansion of CAISO's energy market to include other parts of the Western Interconnection. So, CAISO took a small first step, partnering with Oregon-based utility PacifiCorp to create a shared market in which CAISO and PacifiCorp -- both BAs of the Western Interconnection -- pool resources to balance demand every five minutes using the cheapest energy (often renewables) available in their regions. Thus, in 2014, the EIM was born.

The result has been a major success, even beyond what participants forecast. Three more BAs -- NV Energy, Arizona Public Service, and Puget Sound Energy -- have joined the EIM, and several more have said either they will join or they are studying the option of joining. In 2Q2017, CAISO estimated that, since its inception, the EIM has saved participants $213.24 million in cost savings and the use of surplus renewable energy to displace conventional generating resources. Just in April, May and June 2017, the EIM used roughly 67 GWh of renewable energy that would otherwise have been curtailed. This means that 67 GWh of fossil-fuel energy did not have to come online.

THE REAL MAGIC BEHIND REGIONALIZED MARKETS

The EIM would not exist without a technological backbone, and the hope of further regionalized markets will never come to fruition if that backbone isn't smart and affordable enough to scale sufficiently.

With CAISO's EIM concept in hand, Siemens began the task of creating an energy market management system both to meet CAISO's needs and present what Pradhan called a "low barrier to entry" for others to join.

CAISO couldn't direct EIM candidates to build new systems in order to participate because that would have made the concept less attractive, Pradhan said. Instead, CAISO asked Siemens to expand the existing real-time market to accommodate the EIM. Siemens created a web service interface with functionality based around the existing responsibilities of BA operators and their systems.

"What the EIM participants see is primarily the interface into CAISO on a user interface basis, but also an API basis where they submit their base schedule and then subsequently they submit their bids -- balancing market bids -- for the hourly basis," Pradhan said.

While the EIM structure that Siemens and CAISO developed does present that low barrier to entry that Pradhan described, participation still requires a large volume of work for participants. Other vendors have stepped up to help. Open Access Technology Inc. (OATI), for one, has supported NV Energy's work with the EIM with OATI's webEIM management system, which automates a lot of functionality.

"Without having comprehensive market management software, it would be impossible for BAs to do their job as an EIM participant," Mehdi Assadian, principal market consultant, OATI, said.

As an example, Assadian pointed to third-party tags, which are tags that identify where energy originated and who owns it. Assadian explained that bilateral transactions and third-party tags change very frequently, especially the third-party tags, which may not abide by EIM rules. Any time that information changes, it has to be reported to CAISO hourly and on a five-minute basis. WebEIM fully automates that reporting process.

In addition, Assadian said, webEIM constantly checks transmission limits, and if anything affects those limits, the software immediately captures that information and submits it to CAISO without the BA operator's direct involvement.

Those two tasks alone "tremendously reduce the amount of the work that a BA operator needs to do," he said.

Another important functionality of the software is to suggest bidding strategies for BA operators.

"WebEIM allows the user to create different strategies for different bidding processes, evaluate them, predict the profitability of each one of those strategies, and accordingly, for whichever strategy becomes more profitable, they can create their offer under that strategy and submit it to CAISO," he said. And, once the market is completed for the day, the software back-tests the results against what actually happened in the market so the user can make corrections in future bidding strategies.

Assadian said that webEIM will help stakeholders adjust as energy markets change. For example, as renewables increase on the grid, the locational marginal prices for renewables will decline. At the same time, the need for, and the cost of, ancillary services will increase.

The EIM doesn't provide any ancillary services market -- it's purely energy, so Assadian said it is up to the participants to decide how to balance the energy that they want to offer in the EIM and how to value or keep their ancillary services for themselves.

"The webEIM software can help with this functionality outside the market to allow the market participants to determine what mixture of energy and ancillary services they may want to have in order to come up with a win-win outcome," he said.

THE MARKET WILL CONTINUE TO EVOLVE BUT NOT WITHOUT OPPOSITION

In California, the expectation is that, in time, CAISO will work with other regions beyond EIM to full-blown energy market participation, and Siemens' software will accommodate that change too.

"We're evolving, and it's an ongoing process," Pradhan said. "The evolution has been around making things much more efficient and being able to scale to these larger bodies."

In 2015, the California legislature directed CAISO to study the effects of creating a regional energy market for the western U.S. grid. The study concluded that ratepayers would save between $1 billion and $1.5 billion per year by 2030 in a regional market. This year, a bill advanced in the legislature that would have directed CAISO to begin studying the next steps for regionalization, but that bill failed to move forward.

California Assemblymember Chris Holden in a Sept. 13 statement said that "there is still more to discuss starting with the role of the legislature in review of any proposed governance structure of a new ISO." He added that the legislature will continue work on the issues during the remainder of 2017 and revisit the idea in the second half of the current session.

There is no shortage of opposition to regionalization of Western energy markets, and much of that opposition is grounded in arguments related to jurisdiction, resource planning and clean energy policy. Some people argue that regionalization would allow stakeholders -- specifically from coal-supporting areas -- to influence California's green policies. And, some utilities want a governing structure that decentralizes CAISO's role in the energy market.

In Europe, the path toward implementation of an internal energy market for the operators of the EU grid has clear obstacles, too. A September report from the European Court of Auditors pointed specifically to differences in the member states' methods for implementing a legal framework for the market. In addition, the report said infrastructure currently does not offer security of supply for the market.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum